Updated on Tuesday, October 26, 2021

Adults living with their parents were becoming more common in the U.S. even before the coronavirus pandemic upended jobs and finances, sending an influx of adults back to their parents’ homes.

But hosting adult children at home is just one way parents may financially support their offspring. In a survey of 2,050 U.S. consumers, MagnifyMoney researchers find 22% of adults receive financial support from their parents, whether it’s paying phone bills or helping with rent costs.

That percentage jumps to almost 30% for millennials — who have long been called the “broke generation” or similar derogatives — but they’re not the only group who relies on their parents for financial support.

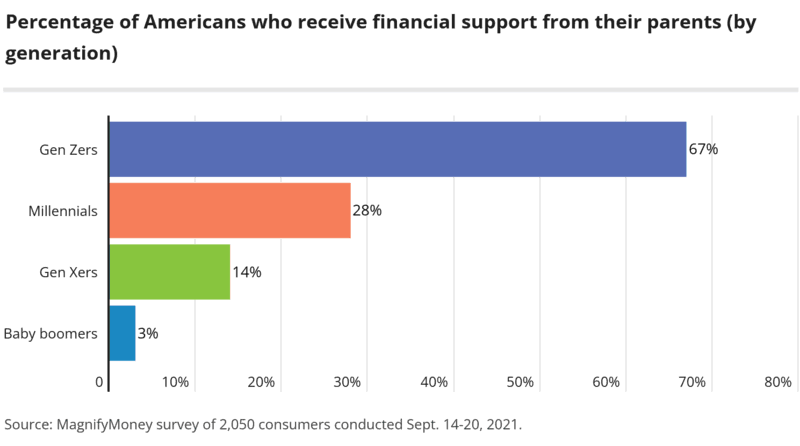

Gen Zers and millennials are most likely to see some financial support from their parents. Gen Zers report receiving the highest share — 67% — of financial support from their parents, which makes sense given many of them may still be in college.

Though millennials may be as old as 40, a notable 28% say their parents offer them some financial support.

Cellphone plans rank as the most popular way parents of Gen Zers, millennials or Gen Xers (ages 41 to 55) support their children. The rate of support for phone plans drops as consumers get older, with no baby boomers reporting parental help in this area:

Housing comes next for the middle generations as 7% of millennials and 3% of Gen Xers live at home rent-free. While a large share — 27% — of Gen Zers also live at home, a larger portion (32%) reap the benefits of their parent's health insurance.

Living with your parents as an adult can be stressful depending on relationships and individual desires, but those benefiting from a rent-free situation should focus on the savings advantage. MagnifyMoney senior content director Ismat Mangla advises those folks to stay diligent with their money while living at home.

While most adults surveyed are currently financially independent from their parents, most — 56% — report receiving some monetary support at one point after turning 18. Most popularly, 24% of respondents say their parents helped pay for college. Another 22% have lived at home rent-free as an adult.

On the contrary, 32% of consumers report being “cut off” financially when they turned 18. Another 15% of folks had to fund their expenses around ages 21 to 22, but 16% report not being completely cut off.

It appears some of those consumers may be passing down a tradition of financial independence to their children. Though the majority — 55% — of parents with adult children say they currently provide at least some occasional financial support for their kids, that percentage drops to 46% among baby boomer parents. Since 60% of baby boomers report never receiving financial help from their parents as adults, they may see value or necessity in cutting the purse strings.

The majority of those surveyed (59%) don’t expect to get an inheritance — assets received after a death — but certain factors make folks more likely to expect to come into some family money in the future.

Those consumers in the highest household income bracket — earning $100,000 or more — are most likely to benefit from an inheritance, with 33% having already received one and 23% expecting to inherit some amount in the future. The majority of those high-earners also expect a large inheritance, with 53% of consumers who earn six figures planning to inherit $100,000 or more.

Though baby boomers are the least likely to report current financial support from their parents, they’re most likely to have already received an inheritance. While just 19% of respondents overall have received an inheritance, that percentage jumps to 37% of baby boomers. What’s more, baby boomers may receive the largest inheritances, with 42% expecting to inherit $100,000 or more.

Trust funds — which hold assets until the recipient meets a legal requisite, like hitting a certain age — don’t seem as popular as inheritances. Just 13% of consumers overall have access or expect to gain access to a trust fund. Once again, however, that percentage rises for folks in the top income tier of $100,000 or more, 15% of whom have access to a trust fund (with another 9% expecting to gain access in the future).

Most respondents aren’t helping their parents financially, but the 21% who provide some support may be doing so somewhat transactionally.

Gen Zers are most likely (37%) to report helping their parents financially. But given most of this support is in the form of housing costs (15%), it’s logical to imagine this financial assistance is more like rent or utility payments. (If you recall, 27% of Gen Zers say they live at home rent-free.)

Consumers who earn at least $100,000 a year are also more likely than consumers overall to help their parents financially, with 27% of these high earners providing some assistance. Notably, 10% of these consumers offer that support through regular lump sums (monthly, annually, etc.).

Gaining total financial independence is a major milestone that most consumers will probably have to face at some point. Though most consumers don’t consider their parents a financial safety net nor serve as a fallback for their parents, a notable 12% of folks do see their parents as a financial safety net.

Whether you’re an adult working your way out of your parent’s money or supporting your own adult children, keep these tips in mind to protect your finances.

MagnifyMoney commissioned Qualtrics to conduct an online survey of 2,050 U.S. consumers from Sept. 14-20, 2021. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. All responses were reviewed by researchers for quality control.

We defined generations as the following ages in 2021:

While the survey also included consumers from the silent generation (age 76 and older), the sample size was too small to include findings related to that group in the generational breakdowns.

Source: https://www.magnifymoney.com/blog/news/parental-financial-support-survey/

Financial SupportFinancial Support EducationFinancial Support For Single MothersFinancial Support If Self IsolatingFinancial Support In A FamilyFinancial Support InformationFinancial Support ResourcesFinancial Support ServicesFinancial Support Systems ReviewsFinancial Support To ParentsFinancial Support To Start A BusinessFinancial Support UnemployedFinancial Support When Self IsolatingFinancial Support While StudyingGet Financial Support OnlineReceive Financial SupportReceive Financial Support From Government