Overspending and my pocketbook go hand-in-hand. Unfortunately, my pocketbook hasn’t really been able to keep up with my expenditures, even though I often act as it does.

It’s easy to neglectfully whip out the plastic to cover frequent trips to the mall. It’s also easy to turn a blind eye to the auto loan, student loan, and credit card balances that still need to be paid off. All that hard-earned money being frivolously spent at my favorite shops could have been going towards paying down my debt.

Ignoring my debts could only go on for so long until I had to face the cold, hard fact that my debt was starting to get out of control. I knew I had to do something, but all those numbers and constant bills piling up on my kitchen table were starting to overwhelm me. I knew I needed to get a hold of my debt and fast.

There are so many reasons to pay off your debt quickly that it would be impossible to focus on just one. So let’s talk about them.

Lower the total amount of interest paid. Getting a loan doesn’t come for free, no matter what type of credit you apply for. Whether it’s an auto loan, credit card, or mortgage, it will be charged interest. The longer you hold onto that debt, the more interest you’ll be paying over the life of the loan. On the flip side, the faster you pay off your debt, the less interest you’ll need to pay. That can translate into a lot of money saved.

Cut back on the number of bills with Trim. The more bills on my plate, the more overwhelmed I get, which is why I made a valiant effort to scale back on the number of payments I was obligated to pay. The more creditors you owe money to, the more bills you’ll be responsible for paying every month. Every time you eliminate one creditor from your record, you’ll have one less bill to pay every month.

Boost your credit score (with credit Sesame). Too much debt can be bad for your credit score. This is especially true if your credit utilization (the amount you owe relative to your credit limit) is far too high. Having a smaller amount of debt can have a positive impact on your credit score, which makes whittling down your debt that much more important.

Increase the odds of loan approval. This might sound counterintuitive, considering the fact that we’re talking about eliminating debts, not adding them. But there are times when loans are essential, especially when it comes to mortgages. If you want to become a homeowner one day, you’ll want to make sure your finances are in good standing, and that includes having minimum debt.

Lenders look at a lot of things before approving borrowers for mortgages, and that includes the amount of debt being carried. More specifically, they look at your debt load compared to your income, known as a debt-to-income ratio.

If your debt is already too high, your income might not be able to accommodate the addition of more debt. In this case, you’d be at risk of being turned down for a home loan. On the other hand, if you apply for a mortgage with minimum debt, your odds of getting approved are higher.

Strengthen financial security. Having too much debt can place you in a potentially risky situation if you are ever in need to access a large lump sum of money to cover an unexpected expense. You also won’t have much money freed up to be put towards setting up a secure financial future, such as saving up for a child’s post-secondary education or retirement. Eliminating all that debt can help you build a financial cushion to fall back on and make you more financially secure overall.

So, now that we know why it’s important to pay off our debts as soon as possible, what are some tools at our disposal that can help make this process easier and more streamlined?

Luckily, we live in a highly technological world that offers a myriad of digital products that can be used to simplify life in just about every aspect. And when it comes to paying down our debt, there are dozens of handy apps out there that can help us get a hold of our debt and move us along the path towards becoming debt-free.

I’ve researched a number of debt payoff apps and have found the following to be especially helpful. You might want to give one of them a try too!

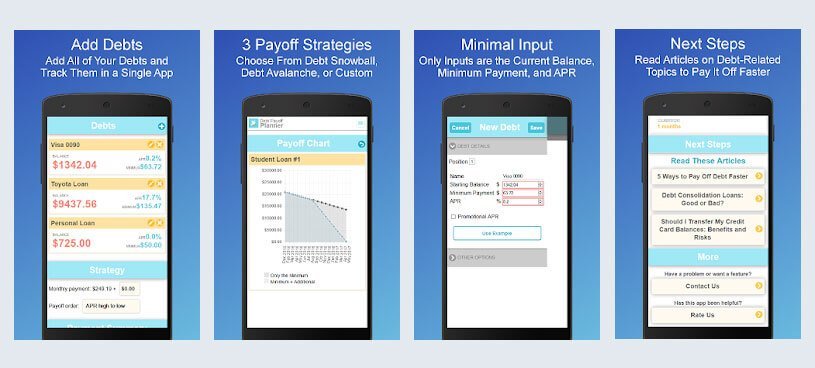

It’s easy to get motivated to pay off your debts with this handy debt planning app. It’s free, and it has some nifty features that allow you to see how long it will take for you to repay all of your debt. It also tells you the amount of money you’d be saving in interest by using specific debt-paying techniques. This app can help you create a detailed, step-by-step plan for paying your debt off.

You can even track your debt payments to help you stay on top of where you’re at. I want to be able to see how any additional payments that I make towards my debt will impact my overall strategy. With the help of Debt Payoff Planner, the time frame for getting out of debt will be updated with each new payment information inputted. This is a great app to help see how much progress is being made.

For $1.99, DebtTracker Pro is an amazing app to help you stay on top of your accounts. The user interface is so simple to use and gives you the full picture of where you stand with all of your debt. All accounts and balances are contained in one easy-to-read screen that helps you focus on getting rid of your debt. You can select the type of repayment method you prefer to use to pay down your debt, or even create a unique one of your own.

The app will automatically make a recommendation about payment amounts for every debt account you enter once you’ve inputted your financial data and selected a payment strategy. It will also display the total amount of interest paid based on the numbers. You’ll even get alerts notifying you when payments are due so you never fall behind.

The Debt Payoff Assistant app uses the Snowball Method to help users pay off their debt. This debt repayment method essentially involves paying off the smallest debts first, eventually working up to the largest. Minimum payments are made on your debts until the first debt is repaid. The extra payment from the debt that has been paid off will then be applied to the next debt load in line. As more debts are paid down, the extra payment amount will increase, hence the name “Snowball” Method.

That said, the app still allows you to pick whichever debt repayment strategy you want, or even multiple strategies. You can keep tabs on as many debts as you have and track extra payments.

One of the best things about the interface is that it will display your total debts, any debts remaining, interest paid, and interest saved. You can also take advantage of the notifications of when your payments are due as well as the payoff date calculator to determine how monthly payment amounts will impact when the debt will be completely paid off.

The Mint app is sweet as a nut, and the best part is that it doesn’t cost a dime. Mint is accessible both through desktop and mobile apps, and it makes the art of laying down budgets a cakewalk. However, it just doesn’t stop at budgets as this app can help you in debt payoff too. Apart from the crystal clear portrayal of debit and credit sides, the Mint app has a “Goals” feature where you can set your objectives towards debt payoff.

You can be as specific as paying off credit card debt, student loans, mortgage, and all other debts as well. Link your bank account with Mint (just ones you want to pay it off with), and set your goal accomplishment date. Mint will track your ins and outs and give you insights about how long will it take to pay off debt, how to speed it up etc. Mint is available on the desktop too, it’s free and it’s fab.

The Tally app is a credit card manager, but there’s a lot more to it than that. Paying off multiple credit cards isn’t easy, with dynamic interest rates and other debts trailing behind. Tally is a debt payoff app that links all cards and determines the best ways to reduce your credit card debt. Not only does this craft an efficient debt payoff strategy, but you can set a designated time period to pay off debts. Keeping that in mind along with all APRs, Tally determines how much you have to pay in order to get out of debt to accomplish your goal.

But the road to debt payoff doesn’t stop here. Tally offers its own line of credit to borrowers with good credit. This line of credit can be used for paying off high-APR credit card debts and replacing them with Tally’s low-APR credit line. The app can be used for free, but qualifying for a line of credit is only for borrowers with good credit. One can apply for it to see if s/he qualifies and it won’t hurt the credit score, as Tally runs a soft credit check.

Student debt is an epidemic haunting millions of Americans. Keeping that in mind, the ChangEd app came up with an Acorns-like strategy. All you got to do is sync your bank account with ChangEd and your purchases will be rounded up to the next dollar. The difference (or change as they call it) will pile up in an FDIC-insured account. It’s doesn’t just stop at rounding off—with the Savings Boost features, one can put more money towards student debt if they have the margin. $20 here and there won’t really hurt.

The good times begin when your account balance reaches $100—ChangEd puts all that money in your student loan payments. Not only does this debt payoff app help in paying off student loans at breakneck speed, but you save thousands of dollars on interest. The best part is that you’re working on student debt payoff without even knowing about it. ChangEd is available on both Android and iOS, it’s free to download and costs just $1 per month.

Americans aged 18 to 24 years carry a heavyweight of credit card debt on their shoulders. On average, each and every American household owes more than $16,000 (approx) in credit card debt. Keeping this alarming statistic in mind, this debt payoff app gives you realistic time-oriented targets to pay off credit card debt. How quickly can I pay off my credit card debt? How much money do I need to have to get there? All these questions are answered in real-time.

The Credit Card payoff app elucidates on the saving factor, how much you can save on interest and how fast can you get out of it. You can toy around with the app too—say, how quickly would you be debt-free if you throw in another $20 towards your credit card payments every month? It’s easy to figure out what credit card payoff strategy suits you and what margin you have for saving more of it. The Credit Card Payoff app is available on Android and is free of cost, which is literally a steal for what it offers.

Ever heard of the Debt Snowball strategy? It’s a tidy hack to tackle debt swiftly and efficiently by paying down the smallest balances first and then moving to bigger debts. While you’re doing so, you stick to minimum payments on the rest of the debts. This debt payoff app plans out the debt snowball strategy and crafts the debt payoff roadmap. It’s not just restricted to the debt snowball method, however. One can craft a debt payoff strategy of their choice as well.

For instance, if you feel that paying down debts with the highest interest rates is a better choice, the Debt Free app can help you with that. Debt payoff is not just restricted to certain cookie molds as every situation is different. That is why this app lets you compare different strategies so that you can figure out how it impacts total interest paid, payback period, and amount of debt eliminated. This one’s only available on iOS and costs $0.99.

They say that bad thing need to be pictured in an elucidated manner so that the witness takes it easily. However, this Debt Payoff app called Unbury.me showcases your progress towards debt payoff in a detailed sense. Just like the debt payoff app above, this one features a debt snowball strategy, but one can go for debt avalanche as well. All you got to do is fill out some blanks and you’d get an idea of what’ll work better for your debt payoff strategy.

You can take all types of debts into consideration—be it credit cards, student loans, or any other form of debt. Play around with the monthly payment amount and you can easily understand how quickly you can be debt-free. Unbury.me is simple at its best, and it starts as a loan calculator which can help pay off the debt by optimizing monthly payments in the best manner possible. This app is easy to use and one can set Unbury.me up in a matter of minutes. Its layout is as easy as an application, and it works on the desktop too.

Technology has literally taken over just about every aspect of life, so why not use it to our advantage? I’m obsessed with these debt payoff apps and I’m convinced that they are instrumental in helping me get my debt down to where it’s at today. Which one of these is the best debt payoff app in 2019? That’s a tough question, but I’m just as convinced that any one of these can help you get back on the path to finally living debt-free too.

<!–

–>

Source: https://www.everybuckcounts.com/the-best-debt-payoff-apps/