Updated on Tuesday, June 22, 2021

Getting denied by a mortgage lender can be frustrating — but obtaining a mortgage by deception is never worth it.

When you apply for a loan, you’ll submit information about your income, employment and the home you wish to purchase. It can be tempting to fudge the numbers to give you more assurance that you’ll be approved. But there’s a simple term for this action — mortgage fraud. Committing mortgage fraud is a serious federal crime that can land you fines of $1 million or more, plus three decades in prison.

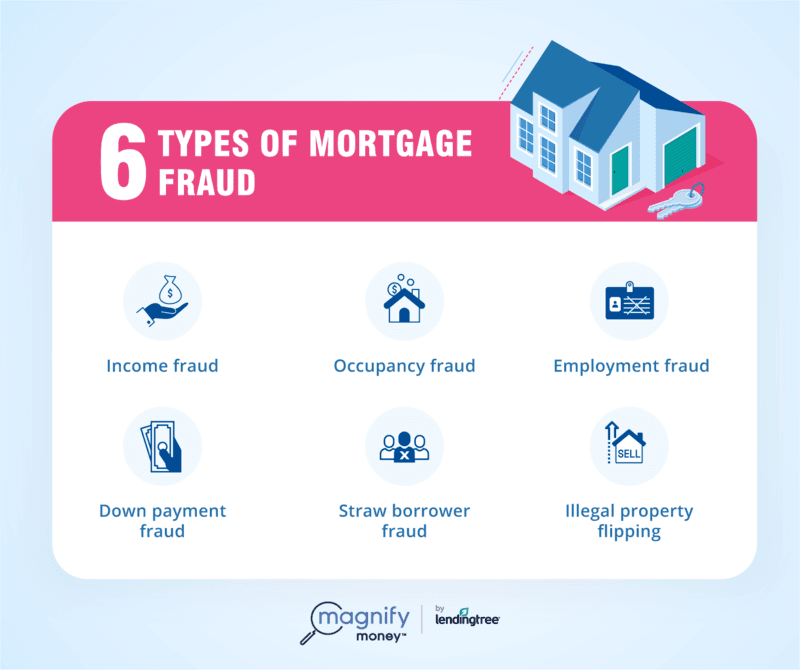

In this article, we’ll go over common types of mortgage fraud and the penalties you might face.

By clicking “See Rates”, you will be directed to LendingTree. Based on your creditworthiness, you may be matched with up to five different lenders in our partner network.

Mortgage fraud is a crime committed when a person intentionally makes a misleading written statement to try to get a mortgage. The lie can be a misrepresentation or an omission of pertinent information. When a bank uses this information to make a decision to approve a mortgage or set the terms of the loan, that’s mortgage fraud. Most of the time, mortgage fraud occurs when a borrower lies on their loan application.

Mortgage fraud can occur through a scheme to make money — known by the FBI as “fraud for profit” — or simply to obtain a house, called “fraud for property” or “fraud for housing.”

Fraud for housing most often occurs when someone misstates their income or assets on a loan application to entice a lender to approve their mortgage, as the lender likely wouldn’t have approved the loan if they knew the real information. Fraud for profit usually involves mortgage lenders or brokers and can take the form of identity theft, straw buyers or illegal flipping schemes.

With income fraud, a borrower tells a lender that they earn more money per year than they actually do. This makes it more likely they’ll be approved for the mortgage, since lenders look to see whether their borrowers make enough to pay back their loan.

This type of fraud was especially common in the early 2000s before the financial crisis, when banks relied on “stated income loans” to boost profits. With these loans, lenders relied solely on the information given to them and did not attempt to verify a borrower’s income.

In this type of mortgage fraud, a borrower says they’ll live in the home they’re buying, but they’re actually purchasing it as an investment property. This is a big deal because many mortgage programs are exclusively used for buying a primary residence.

In addition, mortgages for investment properties are more expensive, and lenders typically require a larger down payment for a home that isn’t one’s principal residence. The interest rates for an investment property are usually higher, too.

Employment fraud occurs when a person submits incorrect information about their job history on their mortgage application. With this type of fraud, a person may put down a company they didn’t really work for, or invent a company altogether.

Lenders want to see steady employment, and often attempt to verify a person’s career history when underwriting a loan.

This can occur in several different ways, but generally involves misrepresenting the source of the down payment made when buying a home. When this happens, a lender may issue a mortgage for an artificially high price.

This can happen if a person who doesn’t have the money for a down payment convinces a home seller to report a higher sales price, or if a person loans a borrower money for a down payment but falsely calls it a gift. This could also include a home builder who tries to sell properties by giving down payment assistance to buyers who don’t disclose it.

If someone other than the person who’ll be living in the home applies for the loan, that can lead to straw borrower fraud. For example, if a person is denied a loan, they may ask their parents to apply in their stead. If the parent claims on the mortgage application that they’ll be the ones living in the home, when it’s really the child — that’s fraud.

This mortgage fraud scheme involves buying a home, then quickly selling the property after submitting a fake appraisal at an artificially high price. The lender issues a mortgage based on the higher price and the fraudsters keep the profits.

This is different from legal property flipping, in which a person buys a home, fixes it up and sells it for a legitimately higher price based on the improvements.

If you make a typo or mistake on your mortgage application, it’s not the end of the world. Contact your lender as soon as possible to get it corrected. Your closing may be delayed, but all of your paperwork needs to be in order.

But if you try to intentionally mislead your lender, you will get into trouble. Mortgage fraud is illegal and investigated by the FBI. Misleading your lender about any aspect of your mortgage application can lead to foreclosure or criminal charges. Bottom line: Obtaining a mortgage by deception just isn’t worth it.

Mortgage fraud penalties can include:

Source: https://www.magnifymoney.com/blog/mortgage/lying-mortgage-application-just-isnt-worth674636019/