Updated on Monday, September 13, 2021

Getting a credit limit increase can be an easy way to boost your credit score — as long as you maintain responsible spending habits. Here, we’ll tell you how to increase your limit when using a Capital One credit card.

First, it’s important to understand that each credit card company has different requirements for limit increases. Before we go over the criteria Capital One uses to grant or deny a limit increase request, let’s discuss why you might want a credit limit increase in the first place.

Capital One offers a variety of credit cards for personal or business use that provide several benefits, from miles and points reward programs to cashback and 0% intro APR promotions.

While the rewards and protections offered by credit cards are nice, if you are spending near or close to your limit each month, your credit score may be taking a negative hit. That’s because “credit utilization” or “amounts owed” is the second most important factor impacting your credit score. Basically, utilization is measured by how much of your credit limit you’re using every month.

Keeping your utilization well below 30% of your credit limit each month is ideal for credit building. Plus, if you are spending less than 30% of your credit limit, it will be easier to pay off the balance in full in a month, allowing you to avoid paying high interest rates. Even if your card currently has a 0% APR for a limited time, it’s best to get into the habit of paying off your balance in full each month.

A credit limit increase can help improve your credit score by giving you more breathing room, as long as you don’t inflate your spending. If you keep your spending at the exact same level after the credit limit increase, your utilization will automatically drop.

For example, say you spend $300 a month on a card with a $1,000 limit – a 30% utilization rate. You requested an increase and now have a $2,000 limit, but continue to spend just $300 a month. Without doing anything differently, you’ve lowered your utilization to 15%, which should help improve your credit score.

Capital One allows users to request a credit line increase either online or by phone. Accounts not eligible for a credit line increase include those that are less than three months old, as well as those that have received a credit line increase or decrease within the past six months.

When you submit a credit line increase request, Capital One looks at a variety of factors, such as on-time payment history, average monthly payment amount, and your credit score. A credit score of 700 and above is generally considered good.

Capital One will also look at your current utilization rate. If you are responsibly using your card and paying more than the minimum each month, this tells Capital One that you can handle potential increased monthly payments if they offer you a credit increase.

What’s nice about this process is that it will not negatively affect your credit. When you submit a request to increase your credit limit, Capital One will use the information they normally receive from the credit bureaus each month, so your credit report will not be pulled.

Requesting a credit limit increase is easy, and it only takes a few minutes. Here’s how to do it online.

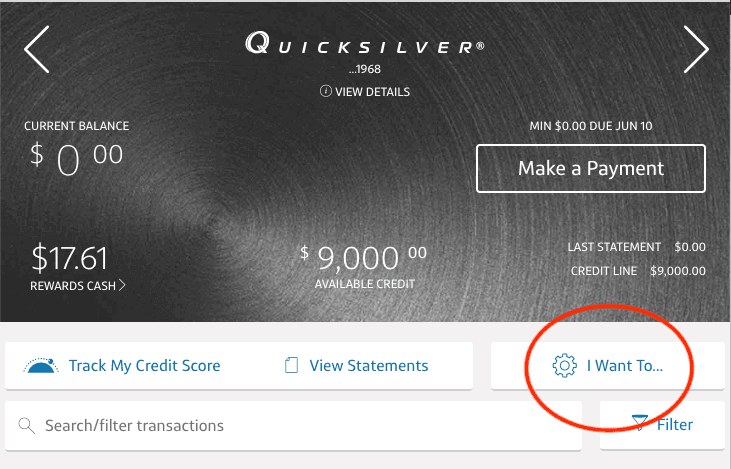

Once you’ve logged in, click on ‘I Want To…”.

Step 2