Updated on Monday, August 9, 2021

Plenty of consumers have made or routinely make impulse buys — that pint of ice cream at the grocery store or a pair of shoes that caught their eye. But when it comes to buying stocks, investors typically want to give their purchases a little more thought.

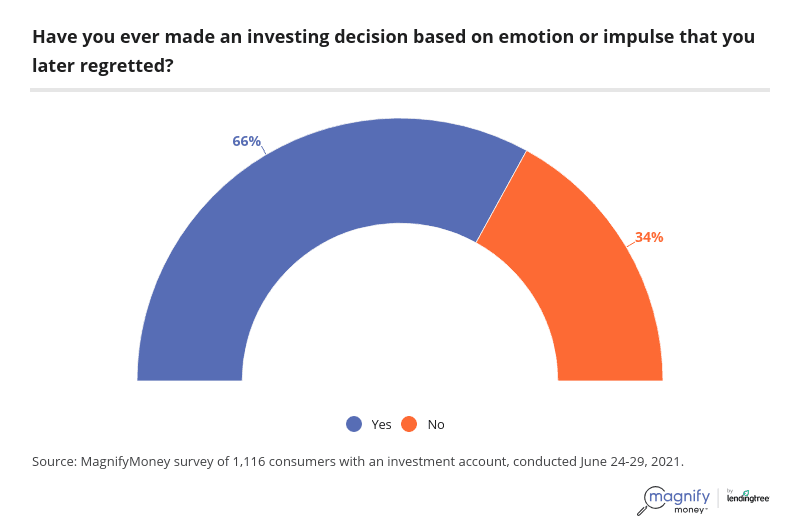

But that doesn’t always happen, given the most recent MagnifyMoney survey finds 66% of investors have regretted an impulsive or emotionally charged investing decision.

Emotions can certainly play a role in major financial decisions such as buying a house or paying for college, but more calculated, logical decisions not based on fleeting feelings might be a better investment strategy. MagnifyMoney researchers surveyed more than 1,100 investors to see if they let emotions influence their portfolios.

Particularly in today’s world, a single headline about the stock market can put investors and consumers on edge. Additionally, the explosion of retail investing apps has made it easier than ever for everyday traders to make market moves quickly.

This perfect storm has likely assisted the 66% of investors who say they’ve made an impulsive or emotionally charged investing decision they later regretted.

Those folks may not all be novice investors, but younger investors are more likely to have made these kinds of regrettable decisions:

And not just impulsive, but sometimes inebriated: 32% of investors admit they’ve traded stocks while drunk. One can imagine how trading apps make this easier than in the old days when an investor might have had to call their broker from the bar. Again, younger investors admit to falling into this trap much more frequently than older traders, with 59% of Gen Zers admitting to drinking and trading, versus just 9% of baby boomers.

Given their apparent habit of making impulsive or impaired investing decisions, it shouldn’t be too surprising that the younger generations are also more likely to lose sleep or cry about their investments.

Investors who manage their portfolios are more likely to make — and regret — impulsive investing decisions than those who let a financial advisor manage their portfolios. Of those who make their own investments, 71% have made a regrettable decision, compared with 59% of those who take a more hands-off approach.

Those who manage their accounts are also more likely to struggle to keep their emotions at bay than those who use a financial advisor. Though most investors — 58% — agree their portfolios perform better when emotions are left out of it, half of the investors who manage their own accounts report struggling to do this, compared with 45% of investors with financial advisors.

Not only are they regretting decisions more often, but those investors managing their portfolios are also more likely to lose sleep over the stock market. The ups and downs can be dizzying at times, and 40% of those self-managing their portfolios have lost sleep over the stock market as a result.

Perhaps these investors are watching the market a bit too closely, MagnifyMoney senior content director Ismat Mangla says.

“If you live and die with the whims of the market every day, you’re bound to get stressed,” Mangla says.

Financial advisors seem to help, as just 34% of investors who employ an advisor report losing sleep over the market.

The stock market swings can be devastating to investors, particularly when a bad day on Wall Street can be a prelude to a long-term crisis. In general, 3 in 10 investors report having cried over investing, and many of those tears came after a loss.

A financial advisor might not always help in these situations, as 30% of investors who use an advisor report crying over investments — the same percentage as those who self-manage. Since one of the most popular reasons for crying is losing money in the stock market — with 43% of folks citing this reason — the tear-inducing losses may have been fairly unavoidable.

Still, a financial pro may help less-experienced traders avoid or at least predict these losses.

On a more positive note, 44% of investors say they feel excited about investing, the most popular sentiment. Stress follows closely behind, with 41% of investors tensing up at the starting bell, but folks overall report feeling relieved more than fearful.

Calm and positive thoughts can’t make your investments perform better, but a careful and informed investing strategy can help ensure your portfolio stays poised for growth.

Use these tips to keep your emotions in check when you’re making investment decisions:

MagnifyMoney commissioned Qualtrics to field an online survey of 1,116 U.S. consumers with an investment account, conducted from June 24-29, 2021. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. All responses were reviewed by researchers for quality control.

We defined generations as the following ages in 2021:

While the survey also included consumers from the silent generation (defined as those 76 and older), the sample size was too small to include findings related to that group in the generational breakdowns.

The “Find a Financial Advisor” links contained in this article will direct you to webpages devoted to MagnifyMoney Advisor (“MMA”). After completing a brief questionnaire, you will be matched with certain financial advisers who participate in MMA’s referral program, which may or may not include the investment advisers discussed.

Source: https://www.magnifymoney.com/blog/news/emotional-investing-survey/