Updated on Monday, November 8, 2021

They don’t call them the golden years for anything — American consumers spend much of their lives working toward retirement, so many have probably thought about their ideal retirement and how to make it happen.

MagnifyMoney researchers set out to identify what a dream retirement looks like for folks, but plenty of personal and societal factors could be impeding those dreams. Researchers found a large share of the 2,050 consumers surveyed expects to retire in debt. Plus, many folks are afraid that Social Security benefits will run out, or that they’ll face a medical crisis that upends their retirement plans.

Whether they’re focused on retiring as soon as possible, or at a more common age but on a beach, consumers have big retirement dreams. Some may have to plan more carefully to avoid a retirement nightmare.

American consumers have big dreams and goals for their retirement, whether leaving the country or simply owning their home. Yet, 46% think they’ll still have debt by the time they retire.

Despite that expectation of debt, just 20% of folks expect to work in their current field or a new field during retirement. While some people will have income other than a salary, retiring with debt on a fixed income may leave some retirees struggling to make ends meet, much less living out the retirement of their dreams.

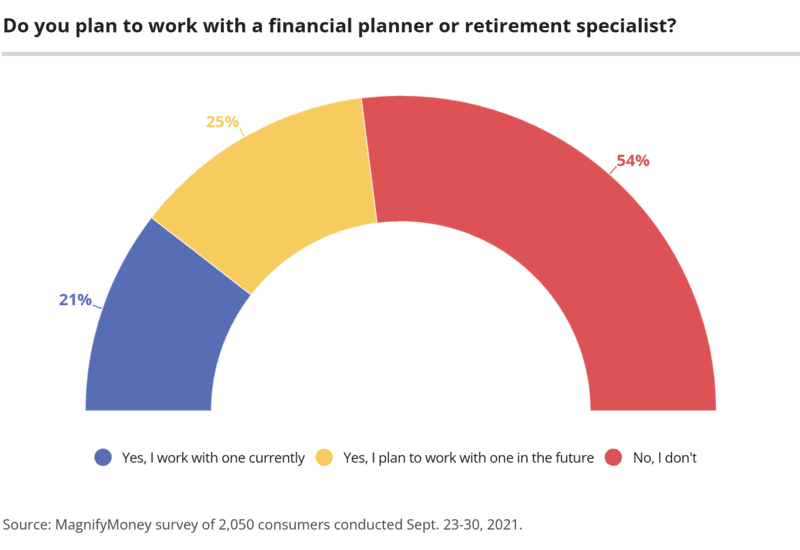

Still, only 21% of consumers report working with a financial planner or retirement specialist — the majority of folks (54%) have no plans to seek expert help to meet their retirement goals.

In general, though, MagnifyMoney senior content director Ismat Mangla encourages people to figure out a budget that addresses saving for retirement and paying off debt.

“Don’t sacrifice saving and investing for retirement until you’re debt-free because then you’ll lose the power of compounding over time,” she says.

For some consumers, a dream retirement is the one that starts the soonest. The most popular (25%) age range when respondents would ideally retire is 60 to 64, but younger generations may be more interested in early retirement.

Though they’ve presumably spent less time in the workforce than older generations, 27% of Gen Zers (ages 18 to 24) and 28% of millennials (ages 25 to 40) want to retire before they turn 50. And while some Gen Xers (ages 41 to 55) may be passed that threshold, 16% say their dream retirement age is below 50. But considering only 10% of retired Gen Xers say they’re living their dream retirement, perhaps they wish they’d left the workforce earlier.

Similarly, 7% of baby boomers (ages 56 to 75) say their dream retirement age is less than 55, but a larger share of retired boomers — 18% — say they are living their dream.

Women are more likely to dream about early retirement, with 21% of women ideally retiring before age 50, versus 15% of men.

Even the humblest of retirement dreams may require some cost-of-living adjustments, but how retirees financially support themselves can vary. It appears a large share of folks are depending on Social Security income to partially or totally fund their retired life, as 43% of folks fear their retirement dreams could be derailed if Social Security runs out.

“It’s important to not rely only on Social Security for your retirement income,” Mangla warns. “Think of it as a supplement, based on how much you have paid into the system.”

Many folks have concerns about their other investments, too, with 22% of consumers worried they’ll lose their retirement savings in a stock market crash. But the most popular concern for retirement hopefuls may not be completely financial — 46% of respondents fear an unexpected health issue could impede their retirement plans.

While a major medical issue could wind up costing enough money to drain retirement savings, it’s feasible that some of those who fear health problems are more concerned with the physical limitations they could put on retirement plans.

Regardless of their dream retirement, just over half of consumers think they’ll need $1 million or more to retire. In contrast, 48% of folks think they can retire with less than $1 million in savings.

Estimating how much money you’ll need to retire will depend on the kind of retirement lifestyle you want and how much time you have to save. There’s no single dollar amount that will allow every American to retire comfortably, but 55% of consumers would ideally just relax in retirement and probably not have to worry about affording bills or other necessities.

Other popular dreams include traveling (50%) and spending time with family (52%), which typically mean having a lot of free time. Still, only 31% of respondents say they want to stop working completely in retirement, so it's possible folks will look to earn an active income at a smaller scale than during their primary working years.

Though most Americans aim to stay in the U.S. to retire, 13% of folks would like to spend their golden years in another country. When it comes to priorities surrounding their retirement location choices, consumers mostly focus on the lifestyle they want (52%) but are nearly equally concerned with the cost of living (51%) and climate (50%).

As such, it makes sense that so many consumers (15% of folks who want to stay domestic) want to retire in Florida — it’s a state known for its warm climate, low cost of living, and leisure activities for retirees and younger families alike. A recent MagnifyMoney study ranked the states by estimated annual costs of living in retirement, placing Florida 22nd.

Meanwhile, California comes with a high cost of living for workers and retirees alike — still, 11% of consumers staying in the country say they’d like to retire in the Golden State, perhaps more focused on the lifestyle and climate advantages. The beach was the most popular (34%) type of location respondents chose for their dream retirement, so California would support that desire as well.

Those looking to retire outside the U.S. mostly select countries with a major benefit — universal health care. Costa Rica tops the list as the most popular international dream retirement location (with 7% of those who want to leave the U.S.). A relatively low cost of living and tropical climate may also make Costa Rica attractive to retirees.

Canada and New Zealand followed, with 6% of hopeful international retirees looking at each option. Consumers also commonly named the following countries as dream retirement destinations:

Whatever your dream retirement looks like, you need to have a plan to get there — or achieve any level of retirement for that matter. Nearly a quarter (24%) of Americans feel they won’t reach their dream retirement goals.

Younger generations, however, are more optimistic: 47% of millennials and 53% of Gen Zers believe they’ll see their retirement dreams realized. Lucky for them, they have the most time to make it happen.

Using these other tips can help anyone work towards a dreamlike retirement:

Everyone has different retirement priorities, but know that there’s no rush to get to your golden years — and there are advantages to waiting. A carefully planned retirement best-timed for your personal situation should be the dream for anyone.

MagnifyMoney commissioned Qualtrics to conduct an online survey of 2,050 U.S. consumers from Sept. 23 to Sept. 30, 2021. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. All responses were reviewed by researchers for quality control.

We defined generations as the following ages in 2021:

While the survey also included consumers from the silent generation (those 76 and older), the sample size was too small to include findings related to that group in the generational breakdowns.

The “Find a Financial Advisor” links contained in this article will direct you to web pages devoted to MagnifyMoney Advisor (“MMA”). After completing a brief questionnaire, you will be matched with certain financial advisers who participate in MMA’s referral program, which may or may not include the investment advisers discussed.

Source: https://www.magnifymoney.com/blog/news/dream-retirement-survey/