“It’s all quiet by the riverside, but the herd is restless.

Fear lurks in the bushes, it’s the hour of the Predator.

He launches his powerful hindquarters propelling him forward like a tracer bullet.

Then he runs flat out, amidst the blur of bodies he spots and chooses his prey.

The prey dodges and swerves but the predator is extremely agile.

A stunning display of dedication and… it’s over with the blink of an eye.”

The above passage portrays how a predator chooses and hunts down his prey. The predator chooses the weakest from the herd, from whom he would face the least resistance. The essence of hunting lies not in the might of the predator but in the precision of the attack.

He ventures outside from his hideous covers (bushes in this case) stealthily. He targets the herd when it is ignorant of his presence.

That’s where he exhibits his killer moves on the most vulnerable of them all; pouncing on from behind and piercing his canines through the throat of his hunt.

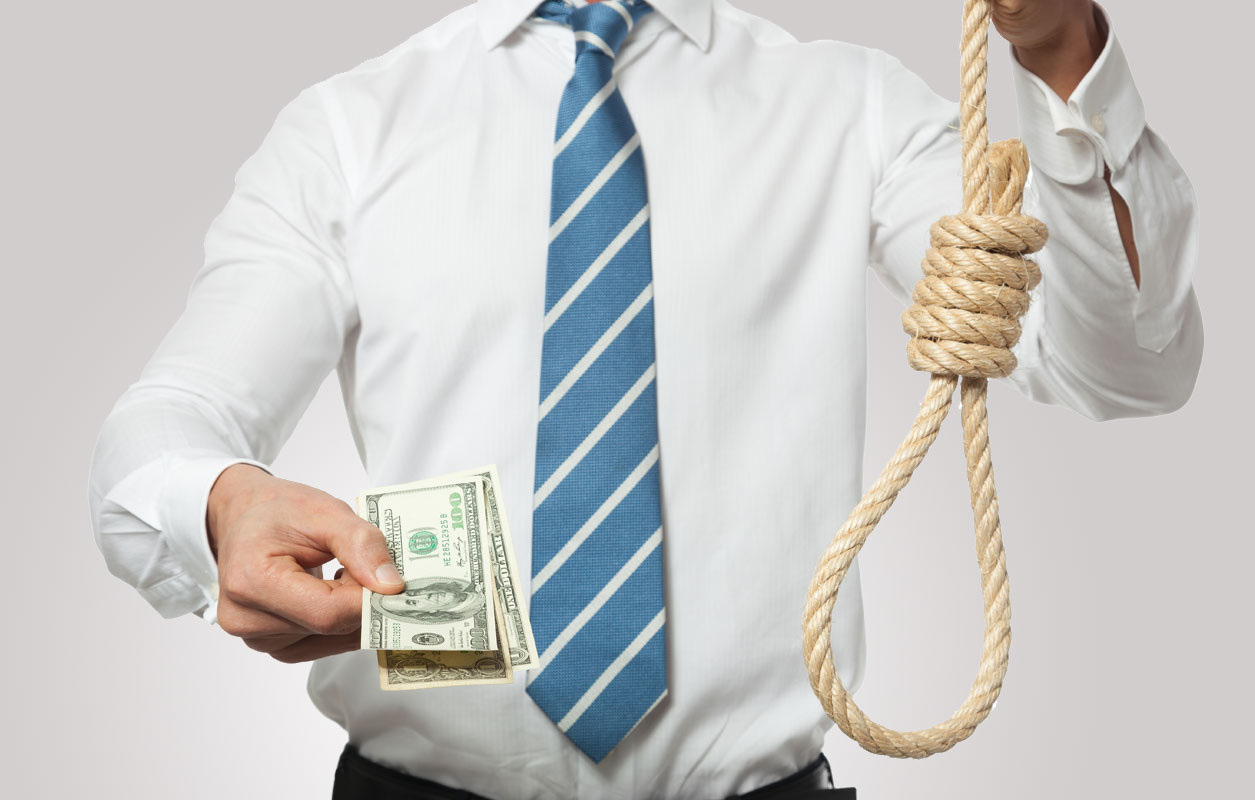

By definition, a predatory loan is a loan which takes undue advantage of the situation of the buyer and exploits his/her vulnerabilities.

Predatory lending also includes activities which involve active concealment of material fact and voluntary manipulation of material information.

This all is done to trick the buyer into buying a loan which has high-interest rates or snatches away the borrower’s equity.

Predatory loans mostly target the weaker sections of the society; the less educated, the empty nester elderly, the poor who are strapped for choices and those in dire need of money.

People who are confronted with emergencies; such as medical bills, home repairs are often the soft target of predatory lending.

Besides, the people who have recently lost their jobs or with a low credit score are often trapped into the vicious web of predatory loans.

For the reason that people amidst such situations may find it hard to add another line of credit or to qualify for a loan despite having enough equity in their homes. The predators feast on the desperateness of the loan seekers.

In the past, predatory lending was confined to home mortgages. The home loans often use the home as collateral which is subjected to change of ownership from the loan buyer to the lender if the buyer defaults.

So, the lenders can profit both from the terms orchestrated into the loan contract and also claim the buyer’s property in case of failure of performance of the contract.

New forms of predatory lending are evolving in this ‘gig economy’. It is important to note that predatory loans may not always be illegal because the lenders often take leverage of lacunae in the law statutes to fulfill their ulterior motives.

A predatory loan can leave the victim homeless (more often than not), with colossal levels of debt and with wrecked credit score.

Predatory lending is also in the form of payday loans, auto loans, tax refund loans or other debt relief loans.

While the financial gurus haven’t yet reached a consensus on what constitutes predatory lending, some actions are considered forbidden.

Example: deliberate and intentional concealment of important facts, false professing of facts, risk-based pricing where the burden of market volatility is shifted on the consumer etc.

Such practices either independently or in convergence with each other, create a vicious circle of debt which is impossible to break out of. Here are some of the common predatory lending practices:-

The lender conceals or manipulates the real costs, conceals the risk involved or embezzles the loan term after the signing of the contract by the consumer.

While the consumer finance industry as a whole depends upon some kind of risk-based pricing; weighing credit history, assessing credit scores etc.

Predatory lending involves charging irrationally high rates to high-risk borrowers, thus increasing their chances of default.

The miscellaneous fees and costs such as documentation fee, closing expenses, and underwriting expenses are much higher than charged by the esteemed lenders in the market. Such costs are shrewdly hidden in the fine print.

Irrelevant and ‘not asked for’ products are forced down the consumer’s throat. These products are bundled up with the cost of a loan, for instance, credit insurance etc.

The lender tricks the loan bearer into refinancing a loan at a higher cost and additional, unscrupulous fees.

Lenders decide loan amount based on the mortgage/collateral (usually a home) and not on the borrower’s ability to repay the loan.

This happens when the minimum monthly payments are too small to even cover the interest, the leftover gets added to the unpaid balance. This could lead up t the borrower having a debt which is many times more than the original loan amount.

When a borrower seeks to refinance a loan with easier or favorable terms, he is charged a hefty prepayment penalty for paying off the loan early.

If you think Redlining is unethical, then chances are that you don’t know a thing about reverse redlining. The lenders prey on neighborhoods with residents of low-income group, basically an area redlined by the conventional banks.

Customers from such areas are charged very high rates to borrow, irrespective of their ability to repay and credit history.

The borrower is tricked into refinancing a home loan with a loan that has a facade of lower payments. However, the refinanced loan carries too many (balloon) payments in the long run.

When the borrower fails to pay the balloon payments, the lender intervenes to refinance the loan with a high-interest and high loan fee.

The lender adds language to a loan contract making it illegal for a borrower to take future legal action for fraud or misrepresentation. The only option, then, for an abused borrower is arbitration, which generally puts the borrower at a disadvantage.

Red signals are indicative, you can choose to withdraw anytime you want.

If a loan document catches your fancy with terms like fast cash, 100% approval, and lowest interest rate etc, you shouldn’t fall for it. The contract might have hidden terms and fees in the fine print which come to the surface after a month or two.

The details of the loan; APR. term length, fees, and penalties are not explicitly mentioned anywhere in the contract. Moreover, the qualification criterion for the agreed terms isn’t clearly stated. You know that it’s time to move on.

Sometimes it’s hard to understand the loan contract, as it was written in some otherworldly language. If the lender isn’t transparent enough, he/she must be hiding a piece of material information, for instance, the real cost of the loan. Along the same lines, dump lenders who commit something else orally and don’t put it in the loan terms.

To play safe. every borrower should ask the lender these questions:-

If the loan is encumbered with variable interest rates that clung very high that the debt becomes multiple times higher than the original loan amount, maintain an arm’s length from such type of offers. Also, ditch the offers that have prepayment penalties as they will make refinancing cumbersome.

A lender should look into your credit history to assess how you have been handling your financial commitments. In such cases, lenders give you the option of making up for your poor credit history by keeping your car as collateral. If you can’t repay the loan, then your assets will be gone.

This could be because lenders are not compliant and want to remain anonymous. If the lender isn’t helping you build the credit, that is a sign that there is more to it than what meets the eye.

Low-income families and other weaker groups of the society are more prone to take a predatory loan compared to high-income counterparts.

A report of the Center for Responsible Lending suggests that the lenders of predatory loans also target the elderly and people with poor credit scores who have no other resorts left.

“There is no escaping the long arms of law”. Predatory lenders may be smart, but our lawmakers are smarter. The law statutes of U.S lay enough provision to counter the malicious intentions of the predators:-

This is a draconian law for predatory lenders. It states that it is mandatory for lenders to specify the APR, total loan amount, all miscellaneous or intrinsic fees chargeable and includes a box that the lender must tick if a prepayment penalty is in play.

This law also gives borrowers the liberty of backing out (in case they smell something fishy) from the contract up till 3 days of signing the contract.

The CFPB has evolved from the Consumer Protection Act of 2010. The CFPB works as the watchdog of federal financial laws that safeguard consumers. With CFPB resources, borrowers can learn to understand loan terms and risks, and air and resolve complaints against lenders.

The jungle of lending industry is dense with too many predators sniffing around. The only thing that will keep you from becoming their prey is your watchful, ardent gaze on your finances and the thirst to explore new havens (financial options) for gloomy days.

Source: https://www.everybuckcounts.com/predatory-loans/